| | | | | | | | |

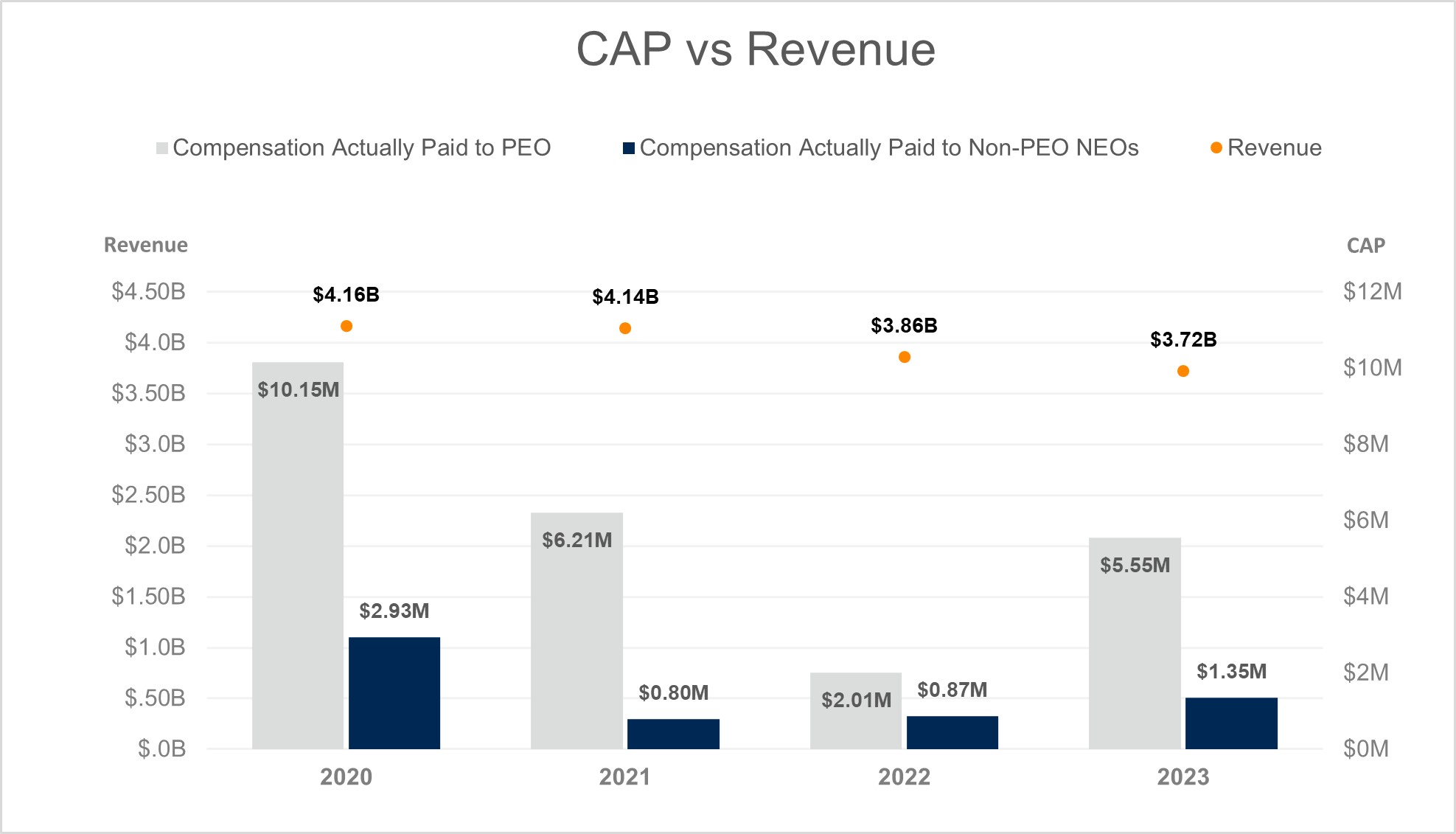

20202022 / 20212023 Peer Group

| |

| | |

Alliance Data SystemsAlight (ALIT) | ICF Intl (ICFI) | | ExlService

| | |

Broadridge Financial1 | | Genpact LTD |

| |

| CACI International Inc (CACI) | Leidos Holdings, Inc (LDOS) | | ManTech Intl

| | |

| CGI Group (GIB) | ManTech Intl* | |

| | |

| Concentrix (CNXC) | Maximus, Inc (MMS) | |

| | |

Cognizant Technology1 | | Paychex1 |

| |

| CSG Systems Intl (CSGS) | TELUS Intl (TIXT) | | Perspecta Inc1

| | |

Cubic Corp1ExlService (EXLS) | TriNet Group (TNET) | | Roper Technologies1

| | |

| Genpact LTD (G) | Veradigm (MDRX) | | Sykes Enterprises Inc1

| 1 | |

|

| | Removed

*ManTech Intl was acquired in August 20212022 and thus removed from the group for 2023-2024 | |

| | |

2021 / 2022 Peer Group

|

| |

Alight2

| | DXC Technology2

|

| |

Alliance Data Systems

| | ExlService

|

| |

Allscripts Healthcare2

| | Genpact LTD

|

| |

CACI International Inc

| | ICF Intl2

|

| |

CGI Group

| | Leidos Holdings, Inc2

|

| |

Concentrix2

| | ManTech Intl

|

| |

CSG Systems Intl

| | Maximus, Inc

|

| |

| | TELUS Intl2

|

The current peer group has remained consistent with the 2022-2023 peer group, with the exception of one company, ManTech Intl. Conduent’s resulting 2023-2024 Peer Group was used to benchmark 2023 compensation and assist in setting 2024 compensation for our named executive officers, as well as to review general pay practices and trends at that time.

Competitive Market Information

At the end of

2020,2022, the Compensation Committee

receivedreviewed a report comparing the compensation of its named executive officers with the compensation of executives in comparable positions at our peer group companies based on the most recent proxy filings (primarily used for the CEO, CFO and General Counsel) as well as general industry survey data to supplement the peer group proxy data. This comparison included compensation data for these elements of pay:

•target short-term incentives;

•total target cash compensation (base salary plus target short-term incentives);

•target long-term incentives; and

•total target direct compensation (total target cash compensation plus target long-term incentives).

The competitive market data was prepared, analyzed, and presented to the Compensation Committee by the Consultant.FW Cook. The market pay range is viewed by the Compensation Committee as a competitive reference point, but that data is not used to match a specific percentile of the market. Emphasis is placed on total target direct compensation. For 2021,2023, the Compensation Committee reviewed total target direct compensation against the market data using the 50th percentile as a reference point. The Compensation Committee exercises judgement in setting individual compensation levels to reflect an assessment of the executive’s experience, responsibilities and expected contributions to Conduent, as well as potential for advancement.

2021 COMPENSATION FOR THE NAMED EXECUTIVE OFFICERS

2021

2023 Compensation for the Named Executive Officers

2023 Total Direct Compensation

Targets

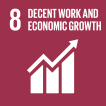

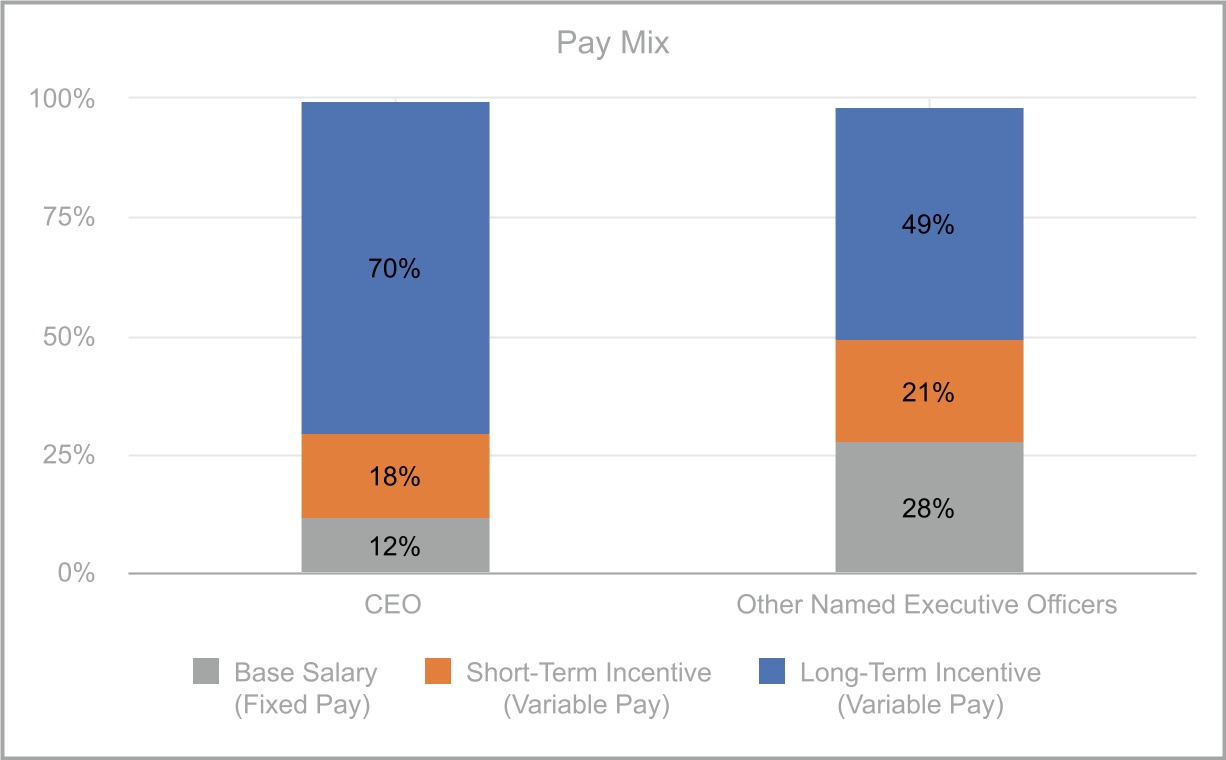

The majority of our named executive officers’ compensation is provided under our variable incentive compensation programs. Variable pay increases with responsibility while long-term incentive compensation represents the greatest component of pay. The 20212023 total direct compensation targets of our named executive officers can be found under the heading “Executive Summary—2021“Our Executive Compensation Program—2023 Total Direct

Compensation Targets for Named Executive

Officers.”Officers” For further information regarding the process the Compensation Committee used to determine compensation for our named executive officers, please see above under “Process for Determining Compensation.”

More complete compensation information appears in the “Summary Compensation Table” on page

45.43.

Base salary is the fixed pay element of our compensation program that reflects the level and scope of responsibility within the Company. The Compensation Committee reviews each named executive officer’s base salary annually as well as in connection with a promotion or other change in responsibility. The table below reflects base salaries for our

active named executive officers as of December 31,

20202022 and December 31,

2021. | | | | |

| | | |

| Executive | | Annual

Base Salary

at 12/31/20 | | Annual

Base Salary

at 12/31/21 |

| | | |

Clifford Skelton | | $750,000 | | $775,000 |

| | | |

Stephen Wood | | $345,000 | | $450,000 |

| | | |

Michael Krawitz | | $450,000 | | $450,000 |

| | | |

Louis Keyes | | $450,000 | | $450,000 |

| | | |

Mark Prout | | $425,000 | | $450,000 |

These2023.

| | | | | | | | |

| Executive | Annual Base Salary at 12/31/22 | Annual Base Salary at 12/31/23 |

| Clifford Skelton | $835,000 | $835,000 |

| Stephen Wood | $525,000 | $525,000 |

| Michael Krawitz | $500,000 | $500,000 |

| Mark Prout | $450,000 | $450,000 |

| Randall King | $450,000 | $450,000 |

| Mark King | $425,000 | $450,000 |

The base pay

changesincrease for

Messrs. Skelton and Prout wereMr. Mark King was made to better align base pay with internal and external

peers, and in the case of Mr. Wood, to recognize his promotion to Chief Financial Officer. Annual base salary rates for all ourpeers. No other named executive officers

are disclosed above under “2021 Total Direct Compensation Targets for Named Executive Officers.”received a base salary increase from 2022 to 2023.

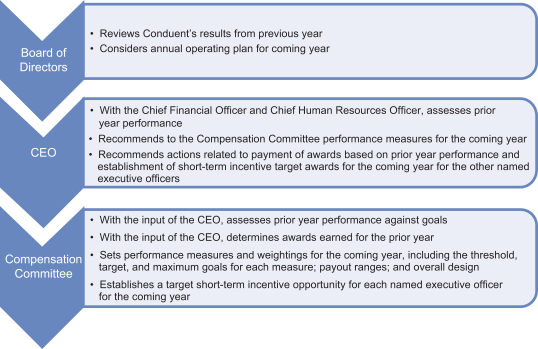

The Annual Performance Incentive Plan provides for short-term incentive awards that reward performance against our annual operating plan, paid in the form of cash to our named executive officers and other eligible employees.associates. Each year, the Compensation Committee reviews the target short-term incentive award opportunity, scaled to the executive’s level of responsibility, and stated as a percentage of base salary, and the maximum payout opportunity.

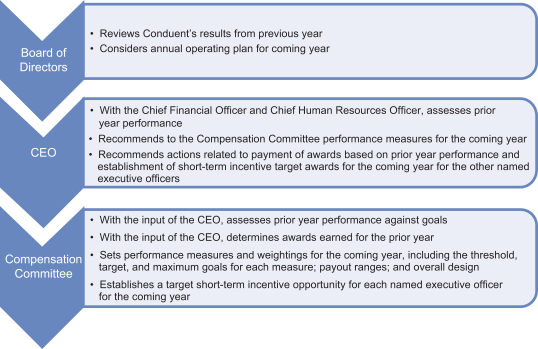

The following chart reflects Conduent’s process for setting short-term incentive awards. This process typically takes place in the first quarter of the year.

Short-Term Incentive Target Award Opportunity for the Named Executive Officers

The annual short-term incentive target award opportunity for each of our named executive officers

considerstakes many factors

into consideration, including scope of responsibility, expected contributions, internal pay equity and competitive executive compensation practices. If an executive’s role or responsibilities change after the terms of the award are approved, the Compensation Committee

is permitted tomay adjust the short-term incentive target award opportunity at that time.

The target award opportunities for all our named executive officers for the 2021 APIP are disclosed above under “2021 Total Direct Compensation Targets for Named Executive Officers.”

The table below depicts the APIP targets

as of December 31. 2020 and December 31. 2021for 2023 for our

active named executive officers.

| | | | |

| | | |

| Executive | | Target Short-

Term Incentive at 12/31/20 (% of Base

Salary) | | Target Short-

Term Incentive

at 12/31/21

(% of Base

Salary) |

| | | |

Clifford Skelton | | 125% | | 135% |

| | | |

Stephen Wood | | 60% | | 75% |

| | | |

Michael Krawitz | | 70% | | 75% |

| | | |

Louis Keyes | | 75% | | 75% |

| | | |

Mark Prout | | 75% | | 75% |

Increases No increases were made to the APIP targets for Messrs. Skelton and Krawitz to more closely alignshort-term incentive target percentages from 2022 to those of our peers and the market. The increase to Mr. Wood’s APIP target percentage is a result of his promotion to Chief Financial Officer.

2023.

| | | | | |

| Executive | Target Short-Term Incentive (% of Base Salary) |

| Clifford Skelton | 150 | % |

| Stephen Wood | 80 | % |

| Michael Krawitz | 75 | % |

| Mark Prout | 75 | % |

| Randall King | 75 | % |

| Mark King | 75 | % |

Short-Term Incentive Performance Measures

The Compensation Committee established the APIP for 20212023 pursuant to which each named executive officer is eligible to receive an incentive payout, assuming Conduent attains certain pre-established performance

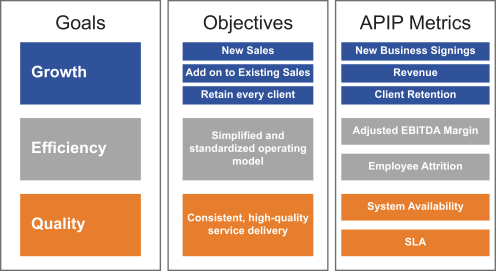

goals. In 2021,2023, the performance goals for the APIP were designed to align with Conduent’s overall strategies, goals and objectives. Our 20212023 performance measures were based on RevenueRevenue (adjusted for currency), Adjusted Earnings Before Interest, Taxes, DepreciationEBITDAMargin and AmortizationMargin, New Business Signings,Net Annual Recurring Revenue (“Net ARR”) Activity. The target for Revenue was lower than our 2022 target and Strategic Goalsactual results, due to business runoff from prior years and the anticipated reduced impact of improvementgovernment stimulus payments in client retention, employee attrition, system availability2023. The defined APIP measures were designed to give a clear line of sight to key business results and SLA.

to encourage growth in revenue without eroding margin.

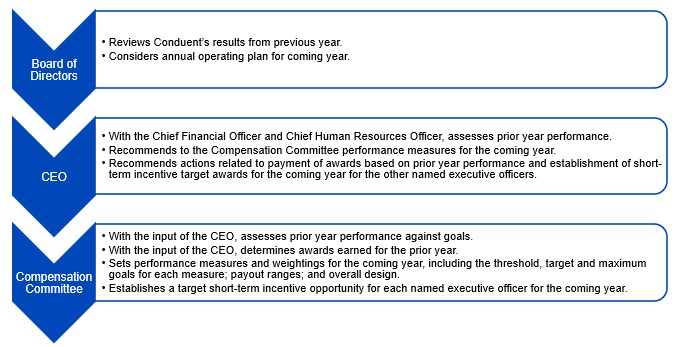

Our targets were consistent with our overall budget for the year.year, as well as guidance to investors. The Compensation Committee did not amend the goals under the APIP for 20212023 or exercise discretion to increase payoutsor decrease funding under the APIP. The 2023 APIP asplan focuses on Conduent’s growth a result of the continued impact of the COVID-19 pandemic challenges onnd efficiency goals, while additional consideration was given to our business. Thequality goals, and is in alignment of our short-term incentive performance measures in the APIP with our Business strategy and goals is depicted below:

business strategy. Our defined APIP metrics were measured as follows:

•Adjusted Revenue was measured at constant currency which excludes the impact of changes in the translation of foreign currencies into U.S. Dollars. (40% weight)

•Adjusted EBITDA Margin represents income or loss before income taxes, divided by Revenue. Adjusted EBITDA is adjusted (40% weight)

•Net ARR Activity (20% weight)

(Please see “Definitions” on page 51 of this Proxy Statement for

interest expense, depreciation and amortization, restructuring and related costs, (gain) loss on divestitures and transaction costs related to divestitures and acquisitions, settlements/reserves/insurance recoveries associated with litigation matters (includes internal and external counsel legal costs), net, other (income) expenses, a charge related to the abandonment of a cloud computing project, legacy charges/credits such as New York Medicaid Management Information System, Health Enterprise and goodwill impairment.New Business Signings/Total Contract Value is measured by estimated future revenues from contracts signed during the year related to new logo, new service line, or expansion with existing customers.

New Business Signings/ACV represents the sum of Annual Recurring Revenue plus Non-Recurring Revenue signing metrics on all new business signed during the year.

Strategic Goals consist of goals relating to improvement in: client retention, employee attrition, system availability and service level agreements.

full definitions.) In no event may an APIP payout exceed the maximum payout (200% of target). The APIP funding level for achieving threshold performance for each performance goal is 25% of target, thetarget. The APIP funding level for achieving target performance is 100% of target, and the APIP funding level for achieving maximum performance is 200%150% of target.target, while the over-achievement funding for Adjusted Revenue and Adjusted EBITDA Margin is 200%. Performance below threshold results in zero APIP funding. Performance results and APIP funding levels are interpolated between these points. The following table notes the 20212023 Threshold, Target, Maximum and MaximumOver-achievement APIP targets for our Non-StrategicAPIP Goals:

| | | | | | | | | | | | |

| Performance Measure | | Threshold

25%

Funding | | | Target

100% Funding | | | Maximum

200% Funding | |

| | | | |

Revenue | | $ | 3,936M | | | $ | 4,100M | | | $ | 4,182M | |

| | | | |

Adjusted EBITDA Margin | | | 10.78 | % | | | 11.46% | | | | 11.69% | |

| | | | |

New Business—Total Contract Value | | $ | 1,680M | | | $ | 2,100M | | | $ | 2,310M | |

| | | | |

New Business Signing—Annual Contract Value | | $ | 560M | | | $ | 700M | | | $ | 770M | |

Adjusted EBITDA must also be greater than 85% of planned budget in order for the APIP to be funded.

2021 Revenue and Adjusted EBITDA Margin targets were set below 2020 actual results due to business runoff from prior years, and the anticipated reduced impact of government stimulus payments in 2021.

| | | | | | | | | | | | | | |

Performance Measure(1) | Threshold

25% Funding | Target

100% Funding | Maximum

150% Funding | Over-Achievement

200% Funding |

Adjusted Revenue(2) | $ | 3,662 | M | $ | 3,775 | M | $ | 3,888 | M | $4,153M |

| Adjusted EBITDA Margin | 9.90 | % | 10.40 | % | 10.90 | % | 11.40 | % |

| Net ARR Activity | $ | 141 | M | $ | 166 | M | $ | 191 | M | NA |

Our overall

20212023 APIP performance was measured as follows:

| | | | | | | | | | | | | | |

| Performance Measure(1) | | Weighting

(A) | | | Actual

Results | | Performance

Achievement

(B) | | | Funding

%

(A) x (B) | |

| | | | | |

Revenue ($M)(2) | | | 25% | | | $4,132M | | | 139 | % | | | 35 | % |

| | | | | |

Adjusted EBITDA Margin | | | 25% | | | 11.76% | | | 200 | % | | | 50 | % |

| | | | | |

New Business Total Contract Value | | | 10% | | | $1,785M | | | 44 | % | | | 4 | % |

| | | | | |

New Business Signing Annual Contract Value | | | 5 | % | | $817M | | | 200 | % | | | 10 | % |

| | | | | |

Strategic Goals: | | | | | | | | | | | | | | |

| | | | | |

Improvement in Client Retention

(Reduction in % losses) | | | 10% | | | Above

Maximum | | | 200 | % | | | 20 | % |

| | | | | |

Reduction in Employee Attrition

(% improvement) | | | 15% | | | Below

Threshold | | | 0 | % | | | 0 | % |

| | | | | |

Improvement in Technology

(% improvement) | | | 5% | | | Above

Maximum | | | 200 | % | | | 10 | % |

| | | | | |

Improvement in SLA

(% improvement) | | | 5% | | | Below

Threshold | | | 0 | % | | | 0 | % |

| | | | | |

Total | | | | | | | | | | | | | 129 | % |

| | | | | |

Actual Funding | | | | | | | | | | | | | 125 | % |

| | | | | |

Adjusted EBITDA: > 85% of Budget | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Performance Measure(1) | Weighting

(A) | Actual

Results | Performance

Achievement

(B) | Funding

%

(A) x (B) |

Adjusted Revenue(2) | 40% | $ | 3,722 | M | 65 | % | 26 | % |

| Adjusted EBITDA Margin | 40% | 10.20 | % | 63 | % | 25 | % |

| Net ARR Activity ($M) | 20% | $ | 62 | M | Below Threshold | 0 | % |

| Total | | | | 51 | % |

| Actual Funding | | | | 51 | % |

____________________

(1)The performance goals were aligned with Conduent’s 2023 operating plan at the time they were established and designed to be challenging yet achievable.

(2)Revenue was adjusted for the impact of divestitures and currency movements from the point at which the targets were set.

Total performance achievement was measured at

129%, while total APIP funding was recommended51% of target, and

approved at 125%. The Compensation Committee approved a slight downward adjustment to support management recommended budget discipline. The 125%this 51% funding level determined the size of the overall pool of funds available for bonuses, while actual bonus payouts were determined on an

individual-by-individual basis, based on performance and the overall

funding level.(1) | The performance measures were aligned with Conduent’s 2021 operating plan at the time they were established and designed to be challenging yet achievable.

|

funding.(2) | Revenue was adjusted for the impact of currency movements from the point at which the targets were set.

|

Determining Short-Term Incentive Award Payouts

After the end of the fiscal year, the CFO confirms the financial results and communicates the results to the Compensation Committee. Subject to the Compensation Committee’s review and approval, any material unusual charges or gains are reviewed with the Compensation Committee for possible impact on APIP calculations.

Each

Results for each performance measure isare assessed and calculated independently. The weighted results of each measure are added together to determine overall performance results. Funding levels are made proportionately for achievement at levels between the goals. Even if If threshold pre-established performance measures are achieved, the Compensation Committee retains discretion to determine a lesseran APIP funding level thanthat differs

from the calculated incentive funding level, or no APIP funding at all, as it deems appropriate. The Compensation Committee also retains its discretion to increase or decrease an individual APIP award based on individual performance, provided that the named executive officer’s award may never exceed their maximum payout

of 200% of target.

2021

2023 Performance for Short-Term Incentive Award Payouts

Following the certification of the financial results for

2021,2023, the Compensation Committee reviewed the achievement of the performance measures under the

20212023 APIP. Mr. Skelton received a short-term incentive equal to the corporate funding level, based on the results stated above. The Compensation Committee granted short-term incentive awards

differing from the approved funding level for Messrs. Wood, Krawitz,

Prout and

Prout above the corporate funding level. These awardsRandall King to reflect individual contributions and performance results for the executive’s function or business unit.

Mr. Mark King was not employed with Conduent at the date of payout and thus did not receive an APIP payout. Details of the

20212023 Target bonus and actual payouts are below:

| | | | | | | | | | | | | | | |

| | | | |

| Executive | | 2021 Bonus Target

Amount | | 2021 Actual Bonus

Amount | | 2021 Actual Bonus

as a % of Target |

| | | | |

Clifford Skelton | | | $ | 1,046,250 | | | | $ | 1,307,813 | | | | | 125 | % |

| | | | |

Stephen Wood | | | $ | 278,864 | | | | $ | 450,000 | | | | | 161 | % |

| | | | |

Michael Krawitz | | | $ | 335,342 | | | | $ | 450,000 | | | | | 134 | % |

| | | | |

Mark Prout | | | $ | 335,702 | | | | $ | 450,000 | | | | | 134 | % |

| | | | |

Louis Keyes | | | $ | 337,500 | | | | $ | 365,000 | | | | | 108 | % |

| | | | | | | | | | | |

| Executive | 2023 | 2023 | 2023 |

Bonus Target

Amount | Actual Bonus

Amount | Actual Bonus

as a % of Target |

| Clifford Skelton | $ | 1,252,500 | | $ | 638,775 | | 51 | % |

| Stephen Wood | $ | 420,000 | | $ | 224,910 | | 54 | % |

| Michael Krawitz | $ | 375,000 | | $ | 200,813 | | 54 | % |

| Mark Prout | $ | 337,500 | | $ | 180,731 | | 54 | % |

| Randall King | $ | 337,500 | | $ | 137,700 | | 41 | % |

| Mark King | $ | 335,856 | | $ | — | | — | % |

The bonus target amount for Mr.

Brian Webb-Walsh did not receive a 2021Mark King was prorated for the increase in base salary from $425,000 to $450,000, effective February 2, 2023. All other APIP

payout duetarget bonus levels for our named executive officers remained consistent from 2022 to

his departure during 2021.2023. Additional information about the short-term incentive opportunities is shown in the “Grants of Plan-Based Awards in

2021”2023” table.

We provide long-term incentives to reward our named executive officers for sustained performance, as a retention incentive and to align

the executive’s interests with shareholders to drive long-term value creation. Awards are intended to encourage a strong ownership stake in the Company to drive superior performance on long-term Company objectives. When determining long-term incentive awards, the

Compensation Committee considers

peermarket data, relative impact of the executive’s position, responsibilities and role at Conduent and each named executive officer’s performance.

During the first fiscal quarter of

2021,2023, the Compensation Committee approved LTIP grants for our named executive officers. As part of this approval, the Compensation Committee established performance goals and award values and an April 1,

20212023 grant date. Additional information regarding the

20212023 LTIP awards can be found in the “Summary Compensation Table” and the “Grants of Plan-Based Awards in

2021”2023” table.

Long-Term Incentive Program and Performance Measures

Long-term incentive awards granted on April 1, 20212023 were made pursuant to the Conduent Incorporated 2021 Performance Incentive Plan. Half50% of the value of each award was granted in the form of Restricted Stock Units, 25%Units; 35% of the value in the form of Performance Restricted Stock Units—Share Hurdle,Units with Revenue Growth Targets, 2023 PRSU—Revenue Growth; and 25%15% in the form of Performance Restricted Stock Units—Units with a relative TSR measure compared with our 2022-2023 Peer group, 2023 PRSU—rTSR. Revenue Hurdle. By adding the PRSU—Revenue Hurdle award, an even greater

emphasis is placedGrowth and rTSR were selected as our long-term metrics to emphasize our continued focus on the strong correlation between revenue growthgrowing revenues and increases inincreasing shareholder value.

Restricted Stock Units vest 1/3 each December 31 of 2021, 20222023, 2024 and 2023,2025, and the number of RSU shares are calculated for each named executive officer by dividing 50% of the approved target long-term incentive award value by the closing price of Conduent Common Stock on the grant effective date. The RSU shares are then rounded down to the nearest whole share.

Our 2023 PRSUs have service condition that require executives to remain with the Company through December 31, 2025. The target number of 2023 PRSU—Revenue Growth shares for our named executive officers was determined by dividing 35% of the approved target long-term incentive award value by the closing

price of Conduent Common Stock on the grant effective date, and then rounding down to the nearest whole share. The target number of 2023 PRSU—rTSR shares granted to each named executive officer was determined by dividing 15% of the named executive officer’s approved long-term incentive award value by the grant date fair value per share, determined using the Monte Carlo simulation. The calculated 2023 PRSU—rTSR shares are then rounded down to the nearest whole share. Both types of 2023 PRSU awards cliff vest on December 31, 2025, and have performance measures tied to three years.

The 2023 PRSU—Revenue Growth targets were established for each calendar year of 2023, 2024 and 2025. The three annual results will be averaged to determine a final payout. The Revenue Growth targets and payout percentages are as follows:

| | | | | | | | | | | | | | |

| Revenue Growth from Previous Year | 2023 | 2024 | 2025 | Payout % |

| Maximum | 0.0% | 5.7% | 6.2% | 200% |

| Target | (2.0)% | 3.2% | 3.2% | 100% |

| Threshold | (4.0)% | 0.7% | 0.2% | 50% |

For our 2023 PRSU—rTSR awards, we measure Conduent’s stock performance relative to our 2022-2023 proxy peer group, established in August 2022. See “Peer Group” section above.

Conduent’s rTSR percentile rank against the 2022-2023 proxy peer group will be measured over the period of April 1, 2023 through December 31, 2025. At the end of the performance period the rTSR results will be based on the following payout matrix:

| | | | | |

| Conduent rTSR | Payout % |

| >=75th Percentile | 150% |

| Median | 100% |

| 25th Percentile | 50% |

Linear interpolation will be used for results between points. Final payout is subject to a cap of 100% if Conduent absolute TSR is negative and there is a total value cap of six times the target value at vest.

Although equity awards generally are granted on a regular annual cycle, the Compensation Committee may grant off-cycle equity awards for special purposes, such as new hires, promotions, retention and recognition. No off-cycle equity awards were granted to our named executive officers in 2023.

Once vested, all our long-term incentive awards, including RSUs and

both types of PRSUs, are paid out in the form of shares of Conduent Common Stock. Any dividends paid during the vesting period would be accrued and

settlesettled at the same time the underlying award vests.

Although equity awards generally are granted on a regular annual cycle, the Compensation Committee may grant off-cycle equity awards for special purposes, such as new hire, promotion, retention and recognition. An off-cycle equity award was granted to Mr. Wood to recognize his promotion to CFO in June 2021. No additional off-cycle equity awards were granted to our named executive officers in 2021.

The

PRSU—Share Hurdle awards vest based on the achievement of share price hurdles and continued service, over the performance period ending December 31, 2023. The Compensation Committee continued to award PRSU—Share Hurdle awards because they are transparently measured, are readily understood by participants,2023 Long-Term Incentives provide direct alignment between shareholder value creation and earned compensation, and serve to help the Company attract and retain the talent needed to deliver our business strategies.

Looking forward to 2024, our PRSUs will be based 70% on revenue growth and 30% on Conduent’s stock price performance relative to peers with both metrics measured over a 3-year performance period.

Performance Results and Payouts Under Prior Equity Awards

2022 Performance — Restricted Stock Units

The

2022 PRSU—Share Hurdle awards were granted with three share price hurdles that require the average closing price of Conduent Common Stock to have increased by

20%15%,

40%30% or

60%50% during a consecutive

20-day trading period from the price of Conduent Common Stock on April 1,

2021,2022, the long-term incentive grant date, a date consistent with Conduent’s previous granting practices. Price

Hurdlehurdle appreciation levels were set

at two timesconsidering the five-year average annual returns of the S&P

Small Cap 600 and Russell 2000 company

indexes.Additionally,indexes

as references, given their average market capitalization and the forecasted growth rates as compared with Conduent.

| | | | | | | | | | | | | | |

| Grant Date Common Stock Price: $5.19 |

| Tranche | Share Hurdle Description | Share

Hurdles | Share Hurdle Achieved as of 12/31/2023 | Service Condition |

| 1 | +15% stock price appreciation | $5.968 | No | December 31, 2022 |

| 2 | +30% stock price appreciation | $6.747 | No | December 31, 2023 |

| 3 | +50% stock price appreciation | $7.785 | No | December 31, 2024 |

The rTSR modifiers for each tranche are based upon Conduent’s percentile rank against the 2021-2022 proxy peer group, as follows:

| | | | | |

| rTSR Percentile | Modifier |

| 75th percentile or above | 105% |

| Median | 100% |

| 25th Percentile | 95% |

Results in between modifier categories are interpolated. All shares remain eligible for vesting for active associates, if share price hurdles are met by December 31, 2024. The individual performance periods and the results for the first tranche rTSR modifier at the completion of the first performance period are as follows:

| | | | | | | | | | | |

| Tranche | Performance Period | Percentile Achievement | rTSR Modifier Results |

| 1 | April 1, 2022 - December 31, 2022 | 28.57 percentile | 95.71 | % |

| 2 | January 1, 2023 - December 31, 2023 | 21.43 percentile | 95.00 | % |

| 3 | January 1, 2024 - December 31, 2024 | To be determined | To be determined |

2021 Performance — Restricted Stock Units

2021 PRSU—Share Hurdle awards have a service condition that requires executives to remain with the Company through December 31 of each ofAwards

The 2021 2022 and 2023. PRSU—Share Hurdle awards do not vest until the date that both the share price hurdle and the service condition have been satisfied. If any tranche of PRSU—Share Hurdle awards has not met the share price hurdle asAward parameters are documented below:

| | | | | | | | | | | | | | | | | |

| Grant Date Common Stock Price: $6.92 |

| Tranche | Share Hurdle Description | Share

Hurdles | Share Hurdle Achieved as of 12/31/2023 | Service Condition | Vesting |

| 1 | +20% stock price appreciation | $ | 8.304 | | No | December 31, 2021 | Service condition met; Unvested |

| 2 | +40% stock price appreciation | $ | 9.688 | | No | December 31, 2022 | Service condition met; Unvested |

| 3 | +60% stock price appreciation | $ | 11.072 | | No | December 31, 2023 | Service condition met; Unvested |

As of December 31, 2023,

it will be forfeited. The target number of PRSU—Share Hurdle shares granted to each named executive officer was determined by dividing 25%none of the

named executive officer’s approved long-term incentive award value by the grant date fair value per share

determined using the Monte Carlo simulation. The calculated PRSU—Share Hurdle shares are then rounded down to the nearest whole share.Detailshurdles for the April 1, 2021 PRSU—Share Hurdle grant are as follows:

| | | | | | | | |

| |

| Grant Date Common Stock Price: $6.92 |

| | | | | |

| Tranche | | Share Hurdle Description | | Price Hurdles | | Price Hurdle Achieved as of 12/31/21 | | Service Condition |

| | | | | |

| 1 | | +20% stock price appreciation | | $8.304 | | No | | December 31, 2021 |

| | | | | |

| 2 | | +40% stock price appreciation | | $9.688 | | No | | December 31, 2022 |

| | | | | |

| 3 | | +60% stock price appreciation | | $11.072 | | No | | December 31, 2023 |

The PRSU – Revenue Hurdle was added to further emphasize revenue growth without eroding margin. The

2021 PRSU—Revenue Hurdle awards vest based upon achievement of annual revenue growth targetsAwards

The Threshold, Target, Maximum and an Adjusted EBITDA margin thresholdActual PRSU—Revenue Hurdle results for the fiscal years ending December 31,third tranche of our 2021 December 31, 2022, and December 31,PRSU—Revenue Hurdle Awards are noted as follows:

| | | | | | | | | | | | | | |

| ($ in millions) | 2021 LTIP Revenue Targets for year ending 12/31/2023 | 2023 |

| Threshold | Target | Maximum | Actual |

| Revenue | 3,870 | | 3,928 | | 3,986 | | 3,722 | |

| Revenue Growth/(Decrease) | 0.5 | % | 2.0 | % | 3.5 | % | (3.4 | %) |

| Minimum Adjusted EBITDA Qualifier: 11.00% | | | | 10.15 | % |

| Revenue Hurdle Achievement | | | | 0 | % |

The results of our 2023

as follows:Change in Revenue Targets:

| | | | | | | | | | | | | | | | |

| | | 2020 Actual | | | 2021 | | | 2022 | | | 2023 | |

Threshold | | | | | | | (3.0 | %) | | | (1.0 | %) | | | 0.5 | % |

Target | | | (6.1 | %) | | | (1.5 | %) | | | 0.5 | % | | | 2.0 | % |

Max | | | | | | | 0.0 | % | | | 2.0 | % | | | 3.5 | % |

The 2021 target Revenue was setrevenue achievement were below 2020 actual results due to business runoff from prior years,threshold level and the anticipated reduced impact of government stimulus payments in 2021, but a significantly improved trend compared with the (6.0%) decline from 2019.

The 2022 revenue target is set at 0.5% growth over 2021 actual revenue, and the 2023 target will be set at 2.0% growth over 2021 revenue. The threshold for payout is 1.5% points from the target and the maximum payout is 1.5% points above the target. A qualifier ofminimum required Adjusted EBITDA Margin at or aboveof 11% is necessary for any payout to be achieved. Each year, 1/3 of the award is eligible to vest. The design of these PRSU—Revenue Hurdle awards aligns with our improvement journey and will reward growth in revenue over the measurement periods.

Conduent surpassed the target levels for 2021 revenue growth, and achieved the minimum Adjusted EBITDA Margin requirement. As a result, on February 4, 2021,. Thus, the Compensation Committee ofcertified 0% payout for the Board of Directors approved the 20212023 tranche of the 2021 PRSU—Revenue Hurdle grant settlement at 126% of targeted shares. The details ofAwards, and the results are as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| ($ in millions) | | | | 2021 LTIP Revenue Targets | | | | | 2021 | |

| | | | | Threshold | | | Target | | | Maximum | | | | | Actual | |

| | | | | | |

Revenue | | | | | 4,038 | | | | 4,100 | | | | 4,163 | | | | | | 4,140 | |

FX (Benefit) / Drag | | | | | | | | | | | | | | | | | | | (8) | |

| | | | | | |

Adjusted Revenue - Constant Currency | | | | | 4,038 | | | | 4,100 | | | | 4,163 | | | | | | 4,132 | |

| | | | | | |

Revenue Growth | | | | | (3.0%) | | | | (1.5%) | | | | 0.0% | | | | | | (0.7%) | |

| | | | | | |

Revenue Hurdle Achievement | | | | | | | | | | | | | | | | | | | 126% | |

PERFORMANCE RESULTS AND PAYOUTS UNDER PRIOR EQUITY AWARDS

2019 – 2021 Performance Share Grant

The three-year measurement period for the 2019 Conduent Long-Term Incentive Plan Performance Shares (“PSU”) ended on December 31, 2021. Conduent did not meet threshold achievement levels for Free Cash Flow (50% weighting) or Adjusted Profit Before Tax (50% weighting). As a result, there was no payout for these 2019 PSU awards.

2020 Performance — Restricted Stock Units

All stock price hurdles related to the April 1, 2020 annual PRSU grantcorresponding shares were achieved prior to December 31, 2021. As a result, the second tranche vested on December 31, 2021. The vesting of the third and final tranche is now solely dependent upon the completion of the final service requirement.

| | | | | | | | | | |

| |

| Grant Date Common Stock Price: $2.06 |

| | | | | | |

| Tranche | | Share Hurdle

Description | | Price

Hurdles | | Price Hurdle Achieved

as of 12/31/21 | | Service Condition | | Vesting |

| | | | | | |

| 1 | | +50% stock price appreciation | | $3.09 | | Yes | | December 31, 2020 | | Vested and settled |

| | | | | | |

| 2 | | +100% stock price appreciation | | $4.12 | | Yes | | December 31, 2021 | | Vested and settled |

| | | | | | |

| 3 | | +150% stock price appreciation | | $5.15 | | Yes | | December 31, 2022 | | Performance condition met. Final vesting upon completion of service condition. |

SAVINGS PLANS

forfeited.

Savings Plans

Conduent Savings Plan (“401(k)”) All our named executive officers are eligible to participate in the Conduent Savings Plan in the same manner as all U.S.

employees. In 2021, afterassociates. After one year of service, participants are eligible for employer matches which are discretionary. The maximum match permitted under the terms of the savings plan is 4% of eligible pay saved, subject to

IRS-qualified plan compensation limits and highly compensated threshold limits.

The Company does not maintain any

non-qualified deferred compensation plans or other retirement plans.

BENEFITS AND PERQUISITES

Benefits and Perquisites

We generally offer medical and dental coverage, life insurance, accidental death insurance and disability benefits programs or plans for all our full-time

employees,associates, as well as customary vacation, leave of absence and other similar policies. Our named executive officers are eligible to participate in these programs and plans on the same basis as all other salaried

employees, except as otherwise disclosed.associates. We do not provide any perquisites to our named executive officers.

EMPLOYMENT AND SEPARATION

Employment and Separation

Named executive officers serve at the will of the Board. This enables the Board to remove a named executive officer whenever it is in the best interests of Conduent, with full discretion of the Compensation Committee to decide on an appropriate severance package. When a named executive officer is removed from his or her position, the Compensation Committee exercises its business judgment in considering whether to approve a severance arrangement in light of all relevant circumstances, including how long the officer was with the Company, past accomplishments and the reasons for separation. If the Compensation Committee does not approve a special severance arrangement for a named executive officer whose position has been eliminated, that officer will be covered under the Company’s U.S. Executive Severance Policy, as applicable.

For separations

Our U.S. Executive Severance Policy, which became effective on May 24, 2022, applies to our most senior executives, including our named executive officers, in the case of a separation due to the elimination of the executive’s

position, the U.S. Executive Severance Policy entitles executives, including ourposition. Our named executive officers

are entitled to

2652 weeks of base

pay,salary paid out over the severance period, with continued health benefits (excluding disability and 401(k) participation)

. This payment is and continued vesting of our long-term incentives during the severance period. These severance benefits are contingent upon signing a release of claims against Conduent, as may be required.

Severance Protection and

Change-in-Control Benefits

The Company also provides certain Change In Control Severance benefits, which are enhanced benefits provided to key management employeesassociates who the Company determines are most likely to be impacted by a

change in control (primarily the Company’s executive officers), as per the Executive Change in Control Severance Plan (“CIC Plan”), which became effective October 1, 2017. In 2021, the Committee updated the levelevent of CIC benefits for executive officers to better reflect market practice, including changing the benefits ofa qualifying termination in connection with a change in control, the CEO fromwould be eligible to receive two and a half times his base salary and target annual incentive, to two and a half times base salary and target annual incentive, as well as making all named executive officers that report directly to the CEO would be eligible forto

receive two times base salary and target annual incentives. The CIC Plan payments and benefits become payable only when both a change-in-control and a qualifying termination taketake place. Conduent does not provide excise tax reimbursement on

severancechange in control payments. Additional information and the amount of the estimated payments and benefits payable to the named executive officers assuming a change in control of Conduent and a qualifying termination of employment is presented in the “Potential Payments Upon Termination or Change in Control” table.

GOVERNANCE OF THE EXECUTIVE COMPENSATION PROGRAMS

Retirement Provision

On February 2, 2023, the Compensation Committee approved a retirement provision applicable to long-term incentive awards granted in 2023 for named executive officers and certain other executives of Conduent, as determined by level. To qualify for the retirement provision, a named executive officer must have:

•a combined age and service equal to 65;

•a minimum age of 60 years old; and

•a minimum of five years of service to Conduent.

Retirement must be agreed on in advance with the Board of Directors, who can determine the time period in its sole and absolute discretion. If a named executive officer qualifies for retirement, the following retirement provisions will apply to LTIP awards granted in 2023:

•RSUs will continue to vest according to the original schedule; and

•PRSUs will follow the original three-year cliff vesting schedule and payout will be based on actual performance at the end of the performance period and the number of full months in the performance period prior to the retirement date.

Continued vesting of unvested awards is contingent upon completion of a successful transition of responsibilities (as determined by the Board); provided, however, that continued vesting would terminate if the executive were to do any of the following:

•accept full time paid employment at a public or private company (with exceptions for (A) board service, teaching, public service, or consulting, (B) employment at a family business, nonprofit, startup or other materially smaller enterprise, or (C) any other employment specifically approved by the CEO for non-executive officers or by the Board for executive officers);

•violate any applicable non-compete, non-solicit, or confidentiality agreements in effect at the time of the retirement; or

•disparage the Company or fail to reasonably cooperate with the Company based on the executive’s historical knowledge.

None of our named executive officers qualified for these retirement provisions as of December 31, 2023.

Governance of the Executive Compensation Programs

The Compensation Committee believes that its programs encourage positive behavior while balancing risk and reward, consistent with the interests of its shareholders. Conduent management conducts risk assessments each year and presents the findings to the Compensation Committee. Based on the assessment of programs covering its employees and executives for

2021,2023, the Compensation Committee determined that its compensation plans, programs and practices do not motivate behavior that is reasonably likely to have a material adverse impact on Conduent, based on the following factors:

•Balanced mix of cash and equity, with incentives tied to both short- and long-term performance

performance;•Balanced mix of performance measures (financial, operational and stock price) approved by the Compensation Committee in advance

advance;•Executive incentive plan payouts are capped

capped; and•Overlapping performance periods for long-term incentives

incentives.

•Independent Compensation Committee oversight

oversight;•Officer stock ownership guidelines

guidelines;•Compensation recoupment policy

policy; and•Anti-hedging and anti-pledging policies

policies.The Company maintains a stock ownership policy for the executive officers in order to ensure they build and maintain a meaningful level of stock ownership. The stock ownership guidelines reflect market practice and are as follows:

•Ownership requirements of 6x, 3x and 1x base salary, for the CEO, CEO’s officer direct reports and all other officers, respectively.

respectively;•Officers are required to retain 50 percent of all shares received upon the vesting of equity awards (net of taxes) until the requirement is achieved.

achieved; and•CEO (or, with respect to the CEO, the Board) has the authority to permit discretionary hardship exceptions from the ownership and holding requirements.

The following types of awards count toward the guidelines described above: Common Stock held outright; unvested Restricted Stock Units net of expected taxes; and PRSUs to the extent the performance hurdle has been achieved but the service condition has not been met, net of expected taxes. The following types of equity awards do not count toward the stock ownership guidelines: unexercised stock options, unearned Performance Stock Units, unearned PRSUs and any cash-settled units. Once stock ownership levels are achieved, named executive officers are required to continue to hold that amount of stock as long as they remain with Conduent.

Trading, Hedging and Pledging

All directors and officers are prohibited from engaging in short-swing trading and trading in puts and calls with respect to our Common Stock and from using any strategies or products to hedge against potential changes in the value of our Common Stock.

Under our insider trading policy, our executive officers may purchase or sell Conduent securities only during “window” periods, which are generally the periods commencing on the second business day following the date of each quarterly earnings announcement and ending on the penultimate trading day of each fiscal quarter. The only exception to this restriction is for our named executive officers who have entered into trading plans pursuant to SEC Rule

10b5-1. As of December 31, 2023, none of our named executive officers have entered into a 10b5-1 trading plan.

In addition, our executive officers are prohibited from pledging our Common Stock as collateral, including holding our Common Stock in a margin account.

Compensation Recoupment Policy (Clawbacks)

Under

In October 2023, our Board adopted an amended and restated Compensation Recoupment Policy that complies with recently enacted SEC rules and Nasdaq listing standards. Conduent’s Compensation Recoupment Policy includes a clawback provision that applies in the event that the Company is required to prepare an accounting restatement. In such event, the Company shall recover any awarded incentive compensation received by an executive officer during the three completed fiscal years immediately preceding the date of such restatement that exceeds the amount that would have been received if based on the restated amounts. The obligation to recover such erroneously awarded compensation is not dependent on if or when the Company files restated financial statements with the SEC and does not require any finding of misconduct by an executive officer or such officer being found responsible for the accounting error leading to the accounting restatement.

Additionally, under the Conduent Performance Incentive Plan and Conduent’sthe Conduent Incorporated Compensation Recoupment Policy, if the Compensation Committee deems a named executive officer to have engaged in an activity that is detrimental to Conduent, it may cancel any awards granted to that individual. In addition, ifIf such a determination is made before any change in control of Conduent, the Compensation Committee may rescind any payment or delivery of any equity and annual cash incentive award that occurred within the six months preceding the detrimental activity. For this purpose, detrimental activity may include a violation of a non-competenon-

compete agreement with Conduent (to the extent permitted by applicable law), disclosing confidential information (except for reporting and other communications protected by “whistleblower” provisions of the Dodd-Frank Act)Wall Street Reform and Consumer Protection Act and rules and regulations thereunder (the “Dodd-Frank Act”)), soliciting an employee to terminate employment with Conduent or soliciting a customer to reduce its level of business with Conduent. If a payment or award is rescinded, the named executive officer will be expected to pay Conduent the amount of any gain realized or payment received in a manner the Compensation Committee or its delegate requires.Conduent’s Compensation Recoupment Policy includes a claw back provision that applies if an accounting restatement is required to correct any material non-compliance with financial reporting requirements. Under this provision, Conduent can recover, for the three prior years, any excess incentive-based compensation (the excess over what would have been paid under the accounting restatement) from executive officers or former executive officers.

Conduent may implement any policy or take any action with respect to the recovery of excess incentive-based compensation that Conduent determines to be necessary or advisable in order to comply with the requirements of the Dodd-Frank Act, including the recoupment of shares of Common Stock issued upon the vesting of a long-term incentive award.

CERTAIN TAX IMPLICATIONS OF EXECUTIVE COMPENSATION

Certain Tax Implications of Executive Compensation

Section 162(m) of the Internal Revenue Code limits to $1 million per year the federal income tax deduction available to corporations for compensation paid in any fiscal year to the corporation’s named executive officers and certain former named executive

officers included in the Summary Compensation Table in the corporation’s proxy statement.officers. While the Compensation Committee considers the deductibility of awards as one factor in determining executive compensation, the Compensation Committee also looks at other factors in making its decisions, as noted above, and retains the flexibility to award compensation that it determines to be consistent with the goals of our executive compensation program even if the awards are not deductible by the Company for tax purposes.

COMPENSATION COMMITTEE REPORT

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with Conduent management. Based upon its review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be incorporated by reference in the Company’s Annual Report on Form

10-K for the year ended December 31,

20212023 and be included in the Proxy Statement for the

20222024 Annual Meeting of Shareholders.

Margarita Paláu-Hernández

Summary Compensation Table

The Summary Compensation Table below provides compensation information for the Company’s Chief Executive Officer, Chief Financial Officer and

the three other most highly compensated executive officers, as

well as our former Chief Financial Officer, as of December 31,

2021. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Name &

Principal

Position | | Year | | | Salary ($) (A) | | | Bonus

($) (B) | | Stock

Awards ($) (C) | | | Non-Equity

Incentive Plan

Compensation

($) (D) | | | All Other

Compensation

($) (E) | | | Total ($) | |

Clifford Skelton | | | 2021 | | | | 770,255 | | | - | | | 3,999,993 | | | | 1,307,813 | | | | - | | | | 6,078,061 | |

Chief Executive Officer | | | 2020 | | | | 697,693 | | | - | | | 2,999,999 | | | | 1,260,957 | | | | 15,000 | | | | 4,973,649 | |

| | | | 2019 | | | | 325,000 | | | - | | | 3,999,990 | | | | - | | | | 16,929 | | | | 4,341,919 | |

Stephen Wood | | | 2021 | | | | 398,241 | | | - | | | 499,977 | | | | 450,000 | | | | - | | | | 1,348,218 | |

Executive Vice President and | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | |

Michael Krawitz | | | 2021 | | | | 450,000 | | | - | | | 734,987 | | | | 450,000 | | | | 8,700 | | | | 1,643,687 | |

Executive Vice President, | | | 2020 | | | | 430,385 | | | - | | | 734,999 | | | | 465,000 | | | | 18,466 | | | | 1,648,850 | |

General Counsel & Secretary | | | 2019 | | | | 34,615 | | | - | | | 199,994 | | | | - | | | | 130 | | | | 234,739 | |

Mark Prout | | | 2021 | | | | 446,506 | | | - | | | 449,993 | | | | 450,000 | | | | 8,700 | | | | 1,355,199 | |

Executive Vice President, | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chief Information Officer | | | 2020 | | | | 406,475 | | | - | | | 499,996 | | | | 500,000 | | | | 1,312 | | | | 1,407,783 | |

Louis Keyes | | | 2021 | | | | 450,000 | | | - | | | 499,993 | | | | 365,000 | | | | 8,025 | | | | 1,323,018 | |

Executive Vice President, | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chief Revenue Officer | | | 2020 | | | | 430,385 | | | - | | | 499,998 | | | | 525,000 | | | | - | | | | 1,455,383 | |

Brian Webb-Walsh, | | | 2021 | | | | 251,403 | | | - | | | 974,986 | | | | - | | | | - | | | | 1,226,389 | |

Former, Executive Vice President & | | | 2020 | | | | 487,770 | | | - | | | 974,998 | | | | 540,000 | | | | 13,317 | | | | 2,016,085 | |

Chief Financial Officer | | | 2019 | | | | 492,692 | | | - | | | 974,994 | | | | - | | | | 18,466 | | | | 1,486,152 | |

2023, as well as an additional former associate (Mark King) not serving as an executive officer on December 31, 2023 and who resigned on January 2, 2024.

| | | | | | | | | | | | | | | | | | | | |

Name &

Principal

Position | Year | Salary

($) | Stock

Awards

($) (A) | Non-Equity

Incentive Plan

Compensation

($) (B) | All Other

Compensation

($) (C) | Total

($) |

| Clifford Skelton | 2023 | 835,000 | | 4,999,996 | | 638,775 | | — | | 6,473,771 | |

| President and | 2022 | 826,808 | | 4,249,995 | | 789,075 | | — | | 5,865,878 | |

| Chief Executive Officer | 2021 | 770,255 | | 3,999,993 | | 1,307,813 | | — | | 6,078,061 | |

| Stephen Wood | 2023 | 525,000 | | 1,149,992 | | 224,910 | | — | | 1,899,902 | |

| Executive Vice President & | 2022 | 514,760 | | 1,149,992 | | 260,000 | | — | | 1,924,752 | |

| Chief Financial Officer | 2021 | 398,241 | | 499,977 | | 450,000 | | — | | 1,348,218 | |

| Michael Krawitz | 2023 | 500,000 | | 999,993 | | 200,813 | | 3,630 | | 1,704,436 | |

| Executive Vice President, | 2022 | 493,173 | | 999,998 | | 242,000 | | 3,050 | | 1,738,221 | |

| General Counsel & Secretary | 2021 | 450,000 | | 734,987 | | 450,000 | | 8,700 | | 1,643,687 | |

| Mark Prout | 2023 | 450,000 | | 749,995 | | 180,731 | | 3,630 | | 1,384,356 | |

| Executive Vice President, | 2022 | 450,000 | | 749,995 | | 236,000 | | 3,050 | | 1,439,045 | |

| Chief Information Officer | 2021 | 446,506 | | 449,993 | | 450,000 | | 8,700 | | 1,355,199 | |

| Randall King | 2023 | 450,000 | | 599,996 | | 137,700 | | 3,630 | | 1,191,326 | |

| Executive Vice President | | | | | | |

| Commercial Solutions | | | | | | |

| Mark King | 2023 | 446,779 | | 799,998 | | — | | 3,630 | | 1,250,407 | |

| Executive Vice President, | | | | | | |

| Government Solutions (Former) | | | | | | |

____________________

Compensation reported in this table is in U.S. dollars and rounded to the nearest dollar.

(A) | Amounts represent base salary earned in fiscal year 2021.

|

(B) | No compensation items are included in this column

|

(C) | Included in this column are the aggregate grant date fair values of equity awards made to our named executive officers in fiscal year 2021 as computed in accordance with FASB ASC Topic 718. For additional information, refer to Note 18 in the Company’s audited financial statements for the fiscal year ended December 31, 2021, included in the 2021 Annual Report on Form 10-K filed with the SEC on February 23, 2022. These amounts reflect an estimate of the grant date fair value and may not be equivalent to the actual value recognized by the named executive officer.

|

| As part of the annual 2021 LTIP award process, PRSU—Revenue Hurdle and PRSU—Share Hurdle awards, as well as, Restricted Stock Unit awards were granted on April 1, 2021. The grant date fair market values and the fair value of the PRSU—Share Hurdle awards is based upon the Monte Carlo method, and both values are shown below. The grant date fair value of the PRSU—Share Hurdle awards is based on the probable outcome of the performance conditions as of the grant date, or target, and the grant date maximum value of these awards shown in the table assumes the PRSU—Share Hurdle awards achieve the fair market value on the grant date.

|

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Name | | Grant Date | | | Performance Restricted Stock Units (PRSU) | | | Restricted Stock Units (RSU) | |

| | PRSU—Revenue Hurdle | | | PRSU—Share Hurdle | |

| | Fair Market Value on

Grant Date | | | Fair Value Based on

Monte Carlo Method | | | Fair Market Value

on Grant Date | | | Fair Market Value on

Grant Date | |

| | | | | | |

Clifford Skelton | | | 4/1/2021 | | | | 999,995 | | | | 1,000,000 | | | | 1,114,300 | | | | 1,999,998 | |

| | | | | | |

Stephen Wood | | | 4/1/2021 | | | | 56,246 | | | | 56,246 | | | | 62,674 | | | | 112,498 | |

| | | | | | |

| | | | 6/30/2021 | | | | 68,745 | | | | 68,745 | | | | 77,070 | | | | 137,498 | |

| | | | | | |

Michael Krawitz | | | 4/1/2021 | | | | 183,747 | | | | 183,747 | | | | 204,749 | | | | 367,494 | |

| | | | | | |

Mark Prout | | | 4/1/2021 | | | | 112,498 | | | | 112,497 | | | | 125,356 | | | | 224,997 | |

| | | | | | |

Louis Keyes | | | 4/1/2021 | | | | 124,996 | | | | 124,998 | | | | 139,286 | | | | 249,999 | |

| | | | | | |

Brian Webb-Walsh | | | 4/1/2021 | | | | 243,743 | | | | 243,749 | | | | 271,610 | | | | 487,493 | |

(D) | Included in this column are payments to our named executive officers under the 2021 APIP based on performance.

|

(E) | “All Other Compensation” noted in this column, is comprised of Conduent’s 401(k) match for 2021 for those named executive officers who elected to participate in Conduent’s 401(k) program. Conduent associates, including our named executive officers, are not eligible for the 401(k) Company match until one full year of service is completed. These 401(k) benefits are equal to the benefits afforded to all Conduent associates. There are no perquisites exclusive to our named executive officers.

|

(A)Included in this column are the aggregate grant date fair values of equity awards made to our named executive officers in fiscal year 2023 as computed in accordance with FASB ASC Topic 718. For additional information, refer to Note 18 in the Company’s audited financial statements for the fiscal year ended December 31, 2023, included in the 2023 Annual Report on Form 10-K filed with the SEC on February 21, 2024. These amounts reflect an estimate of the grant date fair value and may not be equivalent to the actual value recognized by the named executive officer.The grant date fair value of the 2023 PRSU—rTSR awards is based upon the Monte Carlo method, and both the target fair market value and the maximum fair market value at 150% of target, on the date of grant are shown below. The grant date fair value of the 2023 PRSU—Revenue Growth awards is based on the probable outcome of the performance conditions as of the grant date, or target, and the maximum value of these awards are shown below in the table.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Grant Date | 2023 PRSU—rTSR | 2023 PRSU—Revenue Growth | RSU |

Fair Value

Based on

Monte Carlo

Valuation

Method ($) | Value

on Grant Date ($) Based on Stock Price | Maximum Market Value on Grant Date ($) | Fair Value

on Grant Date ($) Based on Stock Price | Maximum Fair Market Value on Grant Date ($) | Fair Market Value on

Grant Date ($) |

| Clifford Skelton | 4/1/2023 | 750,000 | | 871,800 | | 915,390 | | 1,750,000 | | 3,500,000 | | 2,499,996 | |

| Stephen Wood | 4/1/2023 | 172,497 | | 200,511 | | 210,537 | | 402,497 | | 804,994 | | 574,998 | |

| Michael Krawitz | 4/1/2023 | 149,998 | | 174,357 | | 183,075 | | 349,997 | | 699,994 | | 499,998 | |

| Mark Prout | 4/1/2023 | 112,499 | | 130,769 | | 137,307 | | 262,498 | | 524,996 | | 374,998 | |

| Randall King | 4/1/2023 | 89,999 | | 104,615 | | 156,923 | | 209,999 | | 419,998 | | 299,998 | |

| Mark King | 4/1/2023 | 120,000 | | 139,488 | | 261,536 | | 279,998 | | 699,994 | | 400,000 | |

____________________

(B)Included in this column are the payments made to our named executive officers under the 2023 APIP based on performance.

(C)“All Other Compensation” noted in this column is comprised of Conduent’s 401(k) match for 2023 for those named executive officers who elected to participate in Conduent’s 401(k) program. Conduent associates, including our named executive officers, are not eligible for the 401(k) Company match until one full year of service is completed. These 401(k) benefits are equal to the benefits afforded to all Conduent associates. There are no perquisites exclusive to our named executive officers.

Grants of Plan-Based Awards in 2023

The following table provides information regarding our named executive officers’ equity grants and annual cash incentive awards in

2021,2023, including additional detail regarding the potential threshold, target and maximum award opportunities payable under the

20212023 APIP and

2023 PRSU—

Share hurdlerTSR and

2023 PRSU—Revenue

HurdleGrowth awards granted under the

20212023 LTIP. No stock options were awarded in fiscal year

2021. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Name | | Award (A) | | Grant

Date (A) | | | Approval

Date (A) | | | Estimated Future Payout Under Non-Equity Incentive Awards (B) | | | | | Estimated Future Payout Under Equity Incentive Awards (C) | | | All Other

Stock

Awards: Number

of Shares

or Units

(#)(D) | | | Grant

Date Fair

Value of

Stock

Awards

($)(E) | |

| | Threshold ($) | | | Target ($) | | | Maximum ($) | | | | | Threshold (#) | | | Target (#) | | | Maximum (#) | |

Clifford Skelton | | | | | | | | | | | | | 261,563 | | | | 1,046,250 | | | | 2,092,500 | | | | | | | | | | | | | | | | | | | | | | | |

| | | LTIP RSU | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 289,017 | | | | 1,999,998 | |

| | | LTIP PRSU —Revenue Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 72,254 | | | | 144,508 | | | | 216,762 | | | | | | | | 999,995 | |

| | | LTIP PRSU—Share Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 53,675 | | | | 161,026 | | | | 161,026 | | | | | | | | 1,000,000 | |

Stephen Wood | | | | | | | | | | | | | 69,716 | | | | 278,864 | | | | 557,728 | | | | | | | | | | | | | | | | | | | | | | | |

| | | LTIP RSU | | | 6/30/2021 | | | | 5/5/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 18,333 | | | | 137,498 | |

| | | LTIP PRSU —Revenue Hurdle | | | 6/30/2021 | | | | 5/5/2021 | | | | | | | | | | | | | | | | | | 4,583 | | | | 9,166 | | | | 13,749 | | | | | | | | 68,745 | |

| | | LTIP PRSU—Share Hurdle | | | 6/30/2021 | | | | 5/5/2021 | | | | | | | | | | | | | | | | | | 3,425 | | | | 10,276 | | | | 10,276 | | | | | | | | 68,745 | |

| | | LTIP RSU | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 16,257 | | | | 112,498 | |

| | | LTIP PRSU —Revenue Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 4,064 | | | | 8,128 | | | | 12,192 | | | | | | | | 56,246 | |

| | | LTIP PRSU—Share Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 3,019 | | | | 9,057 | | | | 9,057 | | | | | | | | 56,246 | |

Michael Krawitz | | | | | | | | | | | | | 83,836 | | | | 335,342 | | | | 670,684 | | | | | | | | | | | | | | | | | | | | | | | |

| | | LTIP RSU | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 53,106 | | | | 367,494 | |

| | | LTIP PRSU —Revenue Metric | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 13,277 | | | | 26,553 | | | | 39,830 | | | | | | | | 183,747 | |

| | | LTIP PRSU—Share Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 9,862 | | | | 29,588 | | | | 29,588 | | | | | | | | 183,747 | |

Mark Prout | | | | | | | | | | | | | 83,926 | | | | 335,702 | | | | 671,404 | | | | | | | | | | | | | | | | | | | | | | | |

| | | LTIP RSU | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 32,514 | | | | 224,997 | |

| | | LTIP PRSU —Revenue Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 8,129 | | | | 16,257 | | | | 24,386 | | | | | | | | 112,498 | |

| | | LTIP PRSU—Share Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 6,038 | | | | 18,115 | | | | 18,115 | | | | | | | | 112,497 | |

Louis Keyes | | | | | | | | | | | | | 84,375 | | | | 337,500 | | | | 675,000 | | | | | | | | | | | | | | | | | | | | | | | |

| | | LTIP RSU | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 36,127 | | | | 249,999 | |

| | | LTIP PRSU —Revenue Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 9,032 | | | | 18,063 | | | | 27,095 | | | | | | | | 124,996 | |

| | | LTIP PRSU—Share Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 6,709 | | | | 20,128 | | | | 20,128 | | | | | | | | 124,998 | |

Brian Webb-Walsh | | | | | | | | | | | | | 95,625 | | | | 382,500 | | | | 765,000 | | | | | | | | | | | | | | | | | | | | | | | |

| | | LTIP RSU | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 70,447 | | | | 487,493 | |

| | | LTIP PRSU —Revenue Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 17,612 | | | | 35,223 | | | | 52,835 | | | | | | | | 243,743 | |

| | | LTIP PRSU—Share Hurdle | | | 4/1/2021 | | | | 2/5/2021 | | | | | | | | | | | | | | | | | | 13,083 | | | | 39,250 | | | | 39,250 | | | | | | | | 243,749 | |

(A) | RSU refers to Restricted Stock Units subject to service-based vesting conditions. PRSU—Share Hurdle refers to Performance Restricted Stock Units subject to service-based and share hurdle performance-based vesting conditions. PRSU—Revenue Hurdle refers to Performance Restricted Stock Units subject to service-based and revenue hurdle vesting conditions. The “Grant Date” is the effective date of the LTIP awards. The “Approval Date” is the date on which the Compensation Committee, or CEO for awards granted prior to executive officer status, took action to approve these awards.

|

(B) | These columns reflect the threshold, target and maximum payout opportunities for the performance measures under the 2021 APIP set by the Compensation Committee. The actual APIP payout, which was based on 2021 performance is presented in the “Summary Compensation Table” in column (D).

|

(C) | The threshold, target and maximum payout opportunities for the 2021 LTIP Performance Restricted Stock Unit awards were set by the Compensation Committee.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Award

(A) | Grant

Date

| Approval

Date

| Estimated Future Payout Under

Non-Equity Incentive Awards

(A) | | Estimated Future Payout Under

Equity Incentive Awards

(B) | All Other

Stock

Awards:

Number

of Shares

or Units

(#)(C) | Grant

Date Fair

Value of

Stock

Awards

($)(D) |

Threshold

($) | Target

($) | Maximum

($) | Threshold

(#) | Target

(#) | Maximum

(#) |

Clifford

Skelton | APIP | | | 313,125 | | 1,252,500 | | 2,505,000 | | | | | | | |

| LTIP RSU | 4/1/2023 | 2/2/2023 | | | | | | | | 728,862 | | 2,499,997 | |

| LTIP PRSU—Revenue Growth | 4/1/2023 | 2/2/2023 | | | | | 255,102 | | 510,204 | | 1,020,408 | | | 1,750,000 | |

| LTIP PRSU—rTSR | 4/1/2023 | 2/2/2023 | | | | | 127,085 | | 254,169 | | 381,254 | | | 750,000 | |

Stephen

Wood | APIP | | | 105,000 | | 420,000 | | 840,000 | | | | | | | |

| LTIP RSU | 4/1/2023 | 2/2/2023 | | | | | | | | 167,638 | | 574,998 | |

| LTIP PRSU—Revenue Growth | 4/1/2023 | 2/2/2023 | | | | | 58,673 | | 117,346 | | 234,692 | | | 402,497 | |

| LTIP PRSU—rTSR | 4/1/2022 | 2/2/2023 | | | | | 29,229 | | 58,458 | | 87,687 | | | 172,497 | |

Michael

Krawitz | APIP | | | 93,750 | | 375,000 | | 750,000 | | | | | | | |

| LTIP RSU | 4/1/2023 | 2/2/2023 | | | | | | | | 145,772 | | 499,998 | |

| LTIP PRSU—Revenue Growth | 4/1/2023 | 2/2/2023 | | | | | 51,020 | | 102,040 | | 204,080 | | | 349,997 | |

| LTIP PRSU—rTSR | 4/1/2023 | 2/2/2023 | | | | | 25,417 | | 50,833 | | 76,250 | | | 149,998 | |

Mark

Prout | APIP | | | 84,375 | | 337,500 | | 675,000 | | | | | | | |

| LTIP RSU | 4/1/2023 | 2/2/2023 | | | | | | | | 109,329 | | 374,998 | |

| LTIP PRSU—Revenue Growth | 4/1/2023 | 2/2/2023 | | | | | 38,265 | | 76,530 | | 153,060 | | | 262,498 | |

| LTIP PRSU—rTSR | 4/1/2022 | 2/2/2023 | | | | | 19,063 | | 38,125 | | 57,188 | | | 112,499 | |

Randall

King | APIP | | | 84,375 | | 337,500 | | 675,000 | | | | | | | |

| LTIP RSU | 4/1/2023 | 2/2/2023 | | | | | | | | 87,463 | | 299,998 | |

| LTIP PRSU—Revenue Growth | 4/1/2023 | 2/2/2023 | | | | | 30,612 | | 61,224 | | 122,448 | | | 209,999 | |

| LTIP PRSU—rTSR | 4/1/2023 | 2/2/2023 | | | | | 15,250 | | 30,500 | | 45,750 | | | 89,999 | |

Mark King | APIP | | | 83,964 | | 335,856 | | 671,712 | | | | | | | |

| LTIP RSU | 4/1/2023 | 2/2/2023 | | | | | | | | 116,618 | | 400,000 | |

| LTIP PRSU—Revenue Growth | 4/1/2023 | 2/2/2023 | | | | | 40,816 | | 81,632 | | 163,264 | | | 279,998 | |

| LTIP PRSU—rTSR | 4/1/2023 | 2/2/2023 | | | | | 20,334 | | 40,667 | | 61,001 | | | 120,000 | |

____________________

(A)These columns reflect the threshold, target and maximum payout opportunities for the performance measures under the 2023 APIP set by the Compensation Committee. The actual APIP payout, which was based on 2023 performance is presented in the “Summary Compensation Table” in column (B).

(B)These columns reflect the threshold, target and maximum payout opportunities for the 2023 LTIP PRSU awards set by the Compensation Committee.

The number of units at target and maximum for the 2023 PRSU—Share HurdlerTSR awards was determined by dividing the approved values of the respective awards by the closing stock price on the April 1, 2023 grant date ($3.43) and then applying a factor of 1.1143,1.1624, as calculated using the Monte Carlo simulation, and rounding the number of shares down to the nearest share. The threshold number of shares is the minimum number of shares that can be earned ifat threshold performance, or 50%. The maximum number of shares that can be earned is the first share price performance hurdle is achieved.granted shares adjusted by a positive 100% and 50% or the 2023 PRSU—Revenue Growth shares and 2023 PRSU—rTSR shares, respectively.

(C)This column includes RSUs granted under the LTIP on April 1, 2023, which vest ratably on December 31, 2023, December 31, 2024 and December 31, 2025. The number of RSUs was determined by dividing the approved values of the respective awards by the closing stock price on the April 1,st 2023 grant date was $6.92.(D) | This column includes Restricted Stock Units granted under the LTIP on April 1, 2021, which vest ratably on December 31, 2021, December 31, 2022 and December 31, 2023. The number of Restricted Stock Units was determined by dividing the approved values of the respective awards by the closing stock price on the grant date and rounding the number of shares down to the nearest share. The closing stock price on April 1, 2021 was $6.92.

|

(E) | The value reported in this column represents the grant date fair value of these awards determined in accordance with FASB ASC Topic 718. These values are recorded over the requisite serviced period as required by FASB ASC Topic 718. See footnote (C) to the “Summary Compensation Table” and the “Long-Term Incentives” section in the CD&A for additional information on these equity awards.

|

($3.43) and rounding the number of shares down to the nearest share.

(D)The value reported in this column represents the grant date fair value of these awards determined in accordance with FASB ASC Topic 718. These values are recorded over the requisite serviced period as required by FASB ASC Topic 718. See footnote (C) to the “Summary Compensation Table” and the “Long-Term Incentives” section in the CD&A for additional information on these equity awards.

For a description of the material features of the compensation disclosed in the 2021 Grants of Plan-Based Awards in 2023 table see the “Short-Term Incentives” and the “Long-Term Incentives” section of the CD&A.

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table summarizes the unvested stock awards held by the named executive officers at the end of fiscal year

2021.2023. There are no outstanding stock option awards.

| | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Grant

Date | | | Grant Type | | | Number of Shares or Units of Stock That Have Not Vested (#) (1) | | | Market Value of Shares or Units of Stock That Have Not Vested ($) (2) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) (3) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (2) | |

Clifford Skelton | | | 6/28/2019 | | | | RSU | | | | 26,073 | | | | 139,230 | | | | | | | | | |

| | | | 6/28/2019 | | | | RSU | | | | 86,913 | | | | 464,115 | | | | | | | | | |

| | | | 4/1/2020 | | |

| PRSU—Share

Hurdle |

| | | 386,314 | | | | 2,062,917 | | | | | | | | | |

| | | | 4/1/2020 | | | | RSU | | | | 242,766 | | | | 1,296,370 | | | | | | | | | |

| | | | 4/1/2021 | | |

| PRSU—Revenue

Hurdle |

| | | | | | | | | | | 96,339 | | | | 514,450 | |

| | | | 4/1/2021 | | |

| PRSU—Share

Hurdle |

| | | | | | | | | | | 161,026 | | | | 859,879 | |

| | | | 4/1/2021 | | | | RSU | | | | 192,678 | | | | 1,028,901 | | | | | | | | | |

Stephen Wood | | | 9/30/2020 | | |

| PRSU—Share

Hurdle |

| | | 47,539 | | | | 253,858 | | | | | | | | | |

| | | | 9/30/2020 | | | | RSU | | | | 36,688 | | | | 195,914 | | | | | | | | | |

| | | | 4/1/2021 | | |

| PRSU—Revenue

Hurdle |

| | | | | | | | | | | 5,419 | | | | 28,937 | |

| | | | 4/1/2021 | | |

| PRSU—Share

Hurdle |

| | | | | | | | | | | 9,057 | | | | 48,364 | |

| | | | 4/1/2021 | | | | RSU | | | | 10,838 | | | | 57,875 | | | | | | | | | |

| | | | 6/30/2021 | | |

| PRSU—Revenue

Hurdle |

| | | 4,584 | | | | 24,479 | | | | 6,110 | | | | 32,627 | |

| | | | 6/30/2021 | | |

| PRSU—Share

Hurdle |

| | | | | | | | | | | 10,276 | | | | 54,874 | |

| | | | 6/30/2021 | | | | RSU | | | | 18,333 | | | | 97,898 | | | | | | | | | |

Michael Krawitz | | | 11/18/2019 | | | | RSU | | | | 10,353 | | | | 55,285 | | | | | | | | | |

| | | | 4/1/2020 | | |

| PRSU—Share

Hurdle |

| | | 94,646 | | | | 505,410 | | | | | | | | | |

| | | | 4/1/2020 | | | | RSU | | | | 59,477 | | | | 317,607 | | | | | | | | | |

| | | | 4/1/2021 | | |

| PRSU—Revenue

Hurdle |

| | | | | | | | | | | 17,702 | | | | 94,529 | |

| | | | 4/1/2021 | | |

| PRSU—Share

Hurdle |

| | | | | | | | | | | 29,588 | | | | 158,000 | |

| | | | 4/1/2021 | | | | RSU | | | | 35,404 | | | | 189,057 | | | | | | | | | |

Mark Prout | | | 6/28/2019 | | | | RSU | | | | 1,738 | | | | 9,281 | | | | | | | | | |

| | | | 4/1/2020 | | |

| PRSU—Share

Hurdle |

| | | 64,384 | | | | 343,811 | | | | | | | | | |

| | | | 4/1/2020 | | | | RSU | | | | 40,459 | | | | 216,051 | | | | | | | | | |

| | | | 4/1/2021 | | |

| PRSU—Revenue

Hurdle |

| | | | | | | | | | | 10,838 | | | | 57,875 | |

| | | | 4/1/2021 | | |

| PRSU—Share

Hurdle |

| | | | | | | | | | | 18,115 | | | | 96,734 | |

| | | | 4/1/2021 | | | | RSU | | | | 21,676 | | | | 115,750 | | | | | | | | | |

Louis Keyes | | | 9/30/2019 | | | | RSU | | | | 5,360 | | | | 28,622 | | | | | | | | | |

| | | | 4/1/2020 | | |

| PRSU—Share

Hurdle |

| | | 64,385 | | | | 343,816 | | | | | | | | | |

| | | | 4/1/2020 | | | | RSU | | | | 40,461 | | | | 216,062 | | | | | | | | | |

| | | | 4/1/2021 | | |

| PRSU—Revenue

Hurdle |

| | | | | | | | | | | 12,042 | | | | 64,304 | |

| | | | 4/1/2021 | | |

| PRSU—Share

Hurdle |

| | | | | | | | | | | 21,873 | | | | 116,802 | |

| | | | 4/1/2021 | | | | RSU | | | | 24,085 | | | | 128,614 | | | | | | | | | |

(1) | The awards presented in this column include earned unvested Performance Restricted Stock Units—Share Hurdle awards that have met | | | | | | | | | | | | | | | | | | | | | | Name | Grant

Date | Grant

Type | Number of

Shares or

Units of Stock

That Have Not

Vested

(#) (1) | Market Value

of Shares or

Units of Stock

That Have Not

Vested

($) (2) | Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units

or Other Rights

That Have Not

Vested

(#) (3) | Equity

Incentive Plan

Awards: Market

or Payout Value

of Unearned

Shares, Units

or Other Rights

That Have Not

Vested